The company’s networks revenue grows 7.5% year-on-year while Q3 2020 Video revenue was stable quarter-on-quarter. The adjusted EBITDA tops EUR 883 million representing a 62.6% margin with recurring operating expenses reduced 3.7% year-on-year.

SES says that it is on track to deliver on FY 2020 financial outlook with over 97% of group revenue outlook are already contracted. The ‘exceptional’ COVID-19 cost mitigations of around EUR 50 million underpin the adjusted EBITDA outlook (EUR 1,120-1,160 million).

“Our solid performance continued into the third quarter, despite ongoing COVID-19 headwinds, with sustained growth across Networks and stable revenue quarter-on-quarter in our Video business. We were delighted to announce a substantial extension of our relationship with Canal+ across three orbital locations and valued at over EUR 230 million, as well as a meaningful extension of our strategic partnership with Microsoft as an Azure Orbital connectivity partner and satellite partner for Azure Modular Data Centres. We took measures early in the development of the COVID-19 pandemic to protect the bottom line and the benefits of these cost-saving measures are reflected in our resilient Adjusted EBITDA performance. Execution remains the priority with the business well placed to deliver on our full year outlook.

Steve Collar, CEO of SES

Strong progress across four key initiatives that will drive substantial long-term value

SES is on track to clear U.S. C-band by the stated deadlines and to realise the full USD 4 billion of accelerated relocation payments. The company’s Simplify & Amplify initiatives implemented unlocking EUR 40-50 million of annual EBITDA optimisations from 2021 onwards. Having concluded its investigation, the SES Board has decided not to pursue a separation of Networks within SES at this time.

“We are executing strongly on the four transformational initiatives which, together with ongoing execution in the core of the business, will deliver substantial value for our shareholders. I am particularly pleased with the progress being made towards repurposing U.S. C-band with the transition plan fully on track, the FCC auction due to start next month and deadline for realising the first relocation payment now only 13 months away. We have fully implemented measures to focus the business, simplify operations and unlock EUR 40-50 million of annualised EBITDA savings from 2021. We have chosen not to pursue the separation of Networks within SES at this time in favour of driving strong operational focus within our Video and Networks businesses.”

Steve Collar, CEO of SES

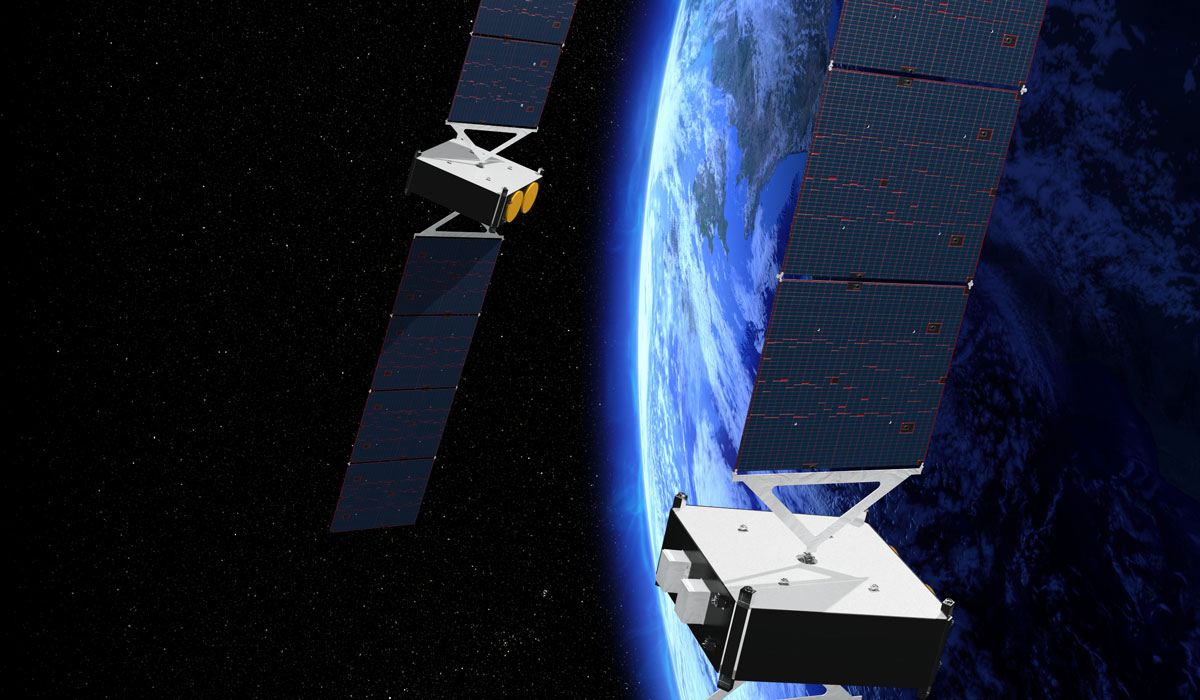

Another key initiative is building the multi-orbit ‘Network of the Future’ through the launch and interoperability of SES-17 and O3b mPOWER. Positioned to capture growth resulting from the projected three-fold increase in addressable market; USD 0.5 billion of contract backlog secured across the programmes with commercial traction increasing as launch approaches. Finally the foundational and expanded partnership with Microsoft and Azure Orbital at the heart of a ‘cloud-first’ strategy to transform service delivery, the company aims to expand service offerings and enhance customer experience.

“We are already strongly differentiated in Networks and, with the launches of SES-17 and O3b mPOWER less than a year away, we are continuing to deliver on our vision for cloud-enabled, multi-orbit, seamless, automated and flexible network services. We have already signed USD 500 million in contract backlog for SES-17 and O3b mPOWER and will report regularly on our progress as we move towards launch of our ‘Network of the Future’. An important enabler for this network is our cloud-first strategy. With SES now an Azure Orbital connectivity provider, our partnership with Microsoft has extended to co-located O3b mPOWER gateways ensuring that Azure is only ever one hop away for our customers.”

Steve Collar, CEO of SES